- The Sovereign Individual Weekly

- Posts

- We've Entered a Doom Loop

We've Entered a Doom Loop

The situation sucks just about any way you choose to look at it.

Debt limit negotiations are mostly a joke to me.

It’s a competition. Political party vs political party and politician vs politician. It’s political brinkmanship designed to score and bank political points for the next election cycle. But here’s the real and simple truth about the debt ceiling negotiations… there can be no winners if a deal doesn’t get done. In fact, everyone involved becomes a loser if no deal gets done.

Why? Because no deal leads to a government shutdown which hurts just about everyone from furloughed government workers, to American’s facing shrinking entitlements, and to voters who grow dissatisfied with politicians that can’t figure out how to avoid policy blunders.

For politicians, not getting a deal done is like banking negative election points. It means impossibly tough questions that will have to get answered during the next election that will reignite negative voter sentiments.

To that end, there’s a warped set of incentives surrounding debt ceiling negotiations that dictate the debt ceiling song and dance. These incentives make it overwhelmingly likely that a deal will get done even if it means kicking the can only slightly farther down the road. As of this weekend, a deal now looks likely to happen given the latest round of negotiations.

The details of the deal don’t matter at this point unfortunately. At least not as far as I’m concerned as an American millennial. Because when you actually look at the big numbers that matter and some of the other trends taking place around the world you start to realize that the train may already be running itself off the metaphorical cliff. And my generation is likely going to be the one that has to deal with the wreckage.

Let me explain.

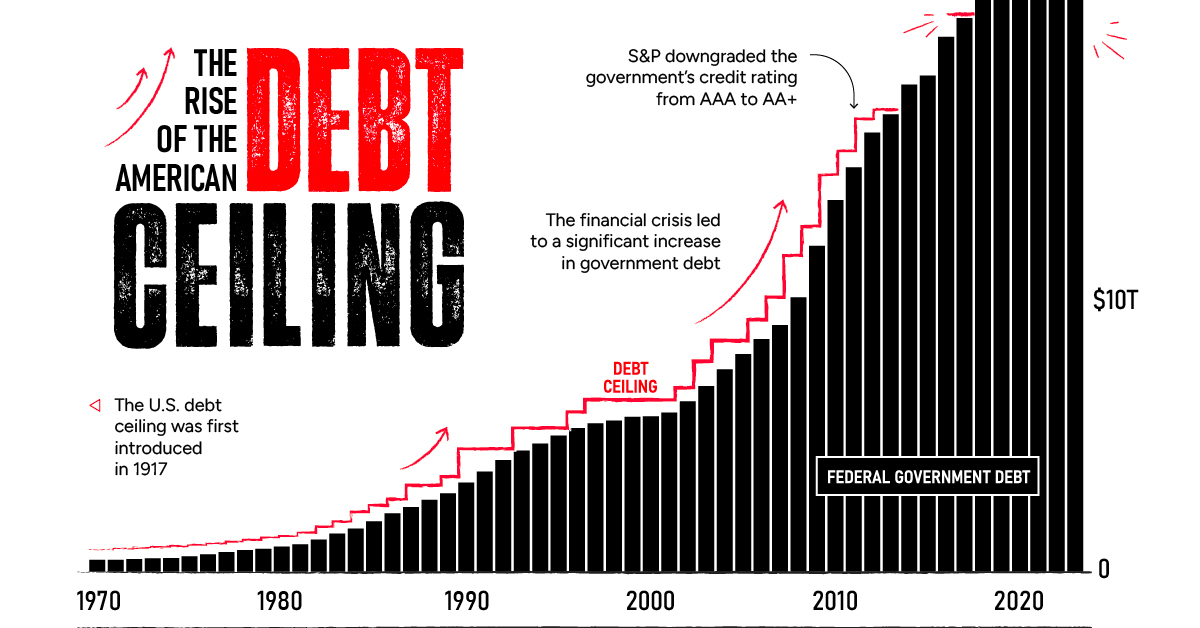

At a high level, this debt ceiling story is about how the US government will get funded and whether or not we can expect some aspect of government shutdown if no deal is struck. Buried within this story though is a bigger and more worrisome narrative. The US Debt to GDP ratio (which is like a measure of a nations debt to its income) has seemingly expanded beyond a point of no return.

In addition to the Visual Capitalist article above, this Pew Research article is from February is a little old but does a good job of breaking down the debt ceiling and the significance of Debt to GDP. The bottom line is that the US Governments costs continue to expand and their ability to pay for those services is not keeping pace.

With a Debt to GDP ratio of over 120%, it’s time to start worrying.

Anyone that’s ever dealt with ballooning debt understands the ramifications. At a certain point, you lose the ability to manage both the debt and interest payments regardless of how much your salary increases. In this case salary can be substituted for tax receipts. At some point, all you’re really doing is making interest payments. For an individual, that can be crushing for quality of life. For a nation, that likely means all types of problems down the road.

Now combine the realities of expanding Debt to GDP trends with some of the other trends we’ve seen lately.

Inflation and resulting contraction of the middle class purchasing power and quality of life. The financial warfare of the West vs Russia that in many ways ushered in a time of mutlipolarism with many nation-states finding ways to strengthen alternative global partnerships while diversifying foreign currency reserves. And of course, the massive accumulation of gold reserves of central banks around the world.

The writing is on the wall for anyone willing to pull their heads out of the sand and look.

Given the warped incentives and posturing around debt deal negotiations, the US has no current and credible way to address it’s ballooning debt aside form watering down it’s currency via printing. This is called debt monetization. The harder truth is that monetizing the debt will only work for some of this debt and the strategy will work only for so long before the value of the US dollar and dollar denominated debt is so unappetizing that nations and people around the world begin to reject it as a pristine asset. Given how destructive inflation has been to the American people, monetizing the debt (printing money to pay it off) is unlikely to be a popular solution.

Again, the writing is on the wall as nations stockpile gold, seek alternative partnerships denominated in alternative assets and currencies.

Here’s the reality, if we get to a point where the appeal of US debt and dollar-denominated assets drops off a cliff, the nature of these debt limit negotiations will change significantly and politicians may realistically be forced to talk about austerity measures. ie: which social programs can we continue to pay for and which do we have to cut back on simply so that we can meet our interest payment obligations? Medicare/medicaid? Social security? Less military?

That’s really the point here.

At this point, it’s not a matter of if but when in the future this change will occur. Warning signs are flashing and being ignored. The question I find myself wondering about is when the real bill will come due. And what will that mean for each subsequent generation as it comes closer to that eventuality. Perhaps most importantly, what will it mean for America and it’s superpower status as debt continues to balloon and other nations diversify away from the US’s growing liabilities.

Rapid Fire

Stock Prices of Office Landlords Plummet as Short Sellers Pile In - The downfall of corporate real estate is becoming a popular narrative. I think this is probably the wrong way to play the trend though. I’d expect a lot of these companies to successfully pivot their holdings into other profitable ventures over time.

What Costco’s Basket Reveals About Consumer Finances - This is a central part of my “recession” thesis. ie: it’s not a recession of lost jobs as much as it is a recession marked by a contraction of the middle class. More people are now teetering on the edge of poverty than there were a year and a half ago. Rapidly rising cost of debt in combination with prolonged high inflation for any length of time will erode the middle class in any economy.

The Freedom to Innovate - “When they want to shut it down, I say double down”

Interview with Arthur Hayes - at roughly 6 minute mark - Arthur talks about a mental model for assessing value against energy. I like this framework a lot. At 44 minutes he talks about when AI lowers the cost of doing work so much that it frees us up to focus on other things like art which is likely to become more valuable. I wrote about that in June 2021, ie: how in a world of AI, UBI ends up as an inevitability and culture takes center stage as a more important type of social currency.

The UK May be Adding Price Caps to Supermarkets - If this happens, we can expect significant downstream effects within the UK economy. It’s probably a good story to follow.

Extras

How satisfied were you with today's newsletter? |

Reply